Regional Terminal Upgrade ongoing!...

Data Migration ongoing, switchnet portal services unaffected!

- Days

- Hours

- Minutes

- Seconds

Data Migration ongoing, switchnet portal services unaffected!

The QUINT 64 NETCORE of the SWITCHBANK NETWORK (SWITCHNET), the leading Interbanking Telecommunication and Clearing House Network revolutionizing the financial landscape. The cutting-edge network offers a comprehensive suite of services designed to streamline banking operations and enhance efficiency for financial institutions worldwide.

Learning about the SWITCHBANK NETWORK, think of it as a hallmark of trust within the global financial landscape, developed by Banks for the Banks. As the pinnacle of banking innovation, SWITCHBANK NETWORK offers unparalleled support tailored specifically to meet the evolving needs of multinational corporations and emerging banking institutions alike. Our NetCore is not just a solution; it's a revolution in banking, empowering institutions with the tools they need to thrive in the digital age. With SWITCHBANK NETWORK, security isn't just a feature – it's a guarantee. Our innovation boasts secure end-to-end tracking of transactions, providing peace of mind and ensuring the integrity of every financial interaction. From multinational corporations executing complex cross-border transactions to emerging banking institutions serving their local communities, SWITCHBANK NETWORK provides a secure and reliable foundation for financial operations. But security is just the beginning. SWITCHBANK NETWORK offers a comprehensive suite of services designed to empower banks with efficiency, security, and compliance in every transaction. From real-time payments and seamless settlement platforms to advanced fraud detection and compliance reporting systems, our platform is equipped with everything banks need to succeed in the modern banking landscape. Innovation is at the heart of everything we do at SWITCHBANK NETWORK. We're constantly pushing the boundaries of what's possible in banking, leveraging cutting-edge technology and industry-leading expertise to deliver solutions that meet the evolving needs of our partners. Whether it's implementing the latest in blockchain technology or revolutionizing cross-border remittance services, we're committed to driving the future of banking forward.

Introducing the BTAN (Bank Transaction Account Number) – a global standard format of bank accounts meticulously crafted by Switchbank International Corporation, setting the gold standard for secure and efficient financial transactions worldwide. The BTAN comprises 34 alphanumeric characters, meticulously structured to ensure seamless communication between financial entities, safeguarding the integrity of each transaction. Here's a breakdown of the BTAN format: Country Code (3 letters): The first three characters of the BTAN represent the country code, indicating the country where the bank account is registered. This ensures clarity and accuracy in international transactions, streamlining the process for global financial interactions. IFEN (International Financial Entity Number): Following the country code, the IFEN uniquely identifies the financial institution associated with the bank account. This identifier ensures that transactions are routed correctly to the intended institution, minimizing errors and delays in fund transfers. Personal Account Number: The remaining characters of the BTAN consist of the personal account number, uniquely identifying each individual account within the financial institution. This allows for precise allocation of funds and seamless reconciliation of transactions within the banking system. The BTAN system incorporates a sophisticated check digit validation system, further enhancing its reliability and security. This system verifies the accuracy of the BTAN, reducing the risk of errors or fraudulent activity in financial transactions.

Is your bank on SWITCHNET yet? If not, buckle up for a ride into the future of banking! more likely your bank is on the network if it has been in operation the last

Picture this: seamless transactions, lightning-fast payments, and ironclad security—all at your fingertips. As the esteemed Single Window Interbanking Telecommunication and Clearing House Network, SWITCHNET isn't just a network; it's a game-changer.

Joining SWITCHNET opens the door to a world of cutting-edge features that will revolutionize the way your bank operates. Real-time payments? Check. Seamless transaction settlement? Double-check.

With advanced fraud detection measures and compliance reporting systems, you can trust that every transaction is Fort Knox-level secure.

But that's not all. With SWITCHNET's Multi-Currency Clearing service, the world is your oyster. Say goodbye to the headaches of cross-border transactions with intermidiary Vostro - Nostro Banking and hello to new global markets ripe for the taking.

In essence, SWITCHNET isn't just a network—it's your bank's ticket to success in today's fast-paced financial landscape. So, what are you waiting for? Strap in and join us on SWITCHNET for a journey into the future of banking that's anything but ordinary.

In today's fast-paced world, waiting for payments to process is a thing of the past. With the Unique End-to-End trackable Real-Time Payments (UETRx), Pronounced {/jʊ:|/treɪs/} as in U trace, on the SWITCHBANK NETWORK, you can enjoy the convenience of swift and secure transactions that happen instantaneously within the network. Gone are the days of waiting hours or even days for funds to transfer between accounts. Whether you're sending money to a friend, paying a vendor, or conducting business with another financial institution, RTP ensures that your transactions are processed in real-time, providing you with immediate access to your funds. But speed isn't the only benefit of UETRx. Our state-of-the-art security protocols ensure that every transaction is conducted with the utmost safety and integrity. With end-to-end encryption and robust fraud detection measures, you can trust that your payments are protected from unauthorized access and fraudulent activity. Moreover, UETRx on SWITCHNet is designed for seamless integration with your existing banking infrastructure. Whether you're a multinational corporation, a small business, or a third party financial institution, the system is flexible and adaptable to meet your unique needs. So why wait? Experience the power of real-time payments with SWITCHBANK NETWORK and enjoy the convenience, security, and efficiency of instant transactions today.

The Real-Time Transfer Settlement (RTTS) Platform: Redefining Efficiency in Fund Management In the dynamic world of finance, efficiency is paramount. That's why SWITCHBANK NETWORK introduces the Real-Time Transfer Settlement (RTTS) Platform – a revolutionary solution designed to streamline fund management processes with unparalleled efficiency and precision.

Empowering Secure Collaboration and Informed Decision-Making In the interconnected world of banking, effective communication is key to success. That's why SWITCHBANK NETWORK introduces Interbank Messaging – a secure and reliable platform designed to facilitate seamless collaboration and informed decision-making among financial institutions. With Interbank Messaging, banks can communicate with confidence, knowing that their sensitive information is protected by state-of-the-art encryption and security protocols. Whether you're sharing transaction details, discussing risk management strategies, or coordinating regulatory compliance efforts, our platform ensures that your communications remain private and secure.

In the ever-evolving landscape of banking, managing liquidity is crucial for ensuring financial stability and fostering growth. That's why SWITCHBANK NETWORK introduces Credit Liquidity Management – a suite of lending tools and services designed to optimize cash positions and empower banks to thrive in today's competitive market. With Credit Liquidity Management, banks have access to a range of lending solutions tailored to their specific needs and objectives. Whether it's providing short-term liquidity to cover operational expenses or financing long-term growth initiatives, our platform offers flexible and customizable lending options to meet the diverse needs of our partner institutions. But our commitment to empowering banks goes beyond just providing capital. At SWITCHBANK NETWORK, we understand the importance of regulatory compliance and risk management in the lending process. That's why our platform incorporates robust risk assessment algorithms and compliance frameworks to ensure that all lending activities are conducted in accordance with regulatory standards and best practices. Moreover, Credit Liquidity Management on SWITCHBANK NETWORK is designed to be transparent and efficient. Our streamlined application and approval process enables banks to access the funds they need quickly and easily, allowing them to seize opportunities and navigate challenges with confidence. But perhaps most importantly, Credit Liquidity Management empowers banks to drive business growth and innovation. By providing access to capital and financial resources, our platform enables banks to expand their lending activities, support their clients' needs, and drive economic development in their communities.

Multi-Currency Clearing: Streamlining International Transactions for Seamless Operations In an increasingly globalized economy, conducting international transactions is a necessity for banks and financial institutions. That's why SWITCHBANK NETWORK introduces Multi-Currency Clearing – a comprehensive solution designed to simplify cross-border transactions and streamline operations for banks operating on a global scale. With Multi-Currency Clearing, banks can seamlessly process transactions in multiple currencies, eliminating the complexities and inefficiencies associated with currency conversion and settlement. Whether it's facilitating cross-border payments, managing foreign exchange transactions, or reconciling accounts in different currencies, our platform provides the tools and infrastructure necessary to ensure smooth and efficient operations. But Multi-Currency Clearing on SWITCHBANK NETWORK is more than just a currency conversion tool. Our platform incorporates advanced algorithms and analytics to optimize currency exchange rates and minimize transaction costs, ensuring that banks can maximize their profitability while providing competitive rates to their customers. Moreover, Multi-Currency Clearing promotes transparency and accuracy in international transactions. By providing real-time visibility into currency exchange rates and transaction statuses, our platform enables banks to track and monitor their cross-border activities with confidence, reducing the risk of errors and discrepancies. But perhaps most importantly, Multi-Currency Clearing empowers banks to expand their global reach and capitalize on new business opportunities. By simplifying international transactions and reducing the barriers to entry, our platform enables banks to serve clients around the world, drive growth, and remain competitive in today's global marketplace.

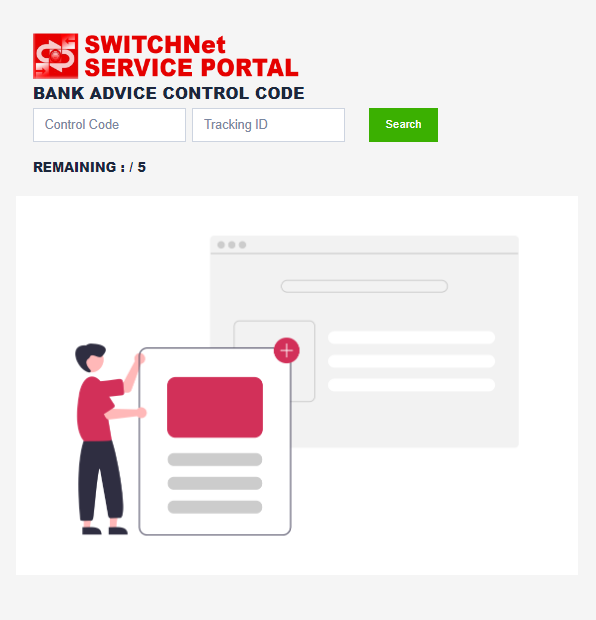

To get started on the SwitchNet Portal, authorized bank system is verified with the registered SWITCHNet IP address.

Once authorization is confirmed, user can proceed to enter login credentials for authentication. A 2FA (Two-Factor Authentication) code will be sent to verify the account login.

If all authentication checks are successfully passed, user will be granted access to the SwitchNet Portal.

Access the SWITCHNet PORTAL if you are a returning client with login credentials!

Fill out form below, and we'll contact you soon.